Cumulative Preferred Dividends in Arrears Should Be Shown in a Corporation’s Balance Sheet as What?

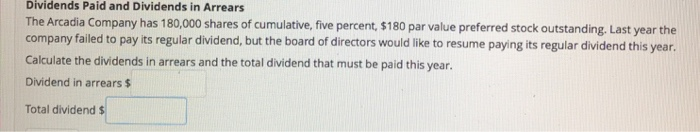

Your cumulative preferred stockholders do not lose out on any omitted or skipped dividends because the dividends accumulate. To get caught up, you pay the oldest dividends first until you reach the current amount due. Cumulative preferred stockholders must receive all of their dividend payment first before other preferred stockholders and common stockholders receive their dividends. These dividend payments are guaranteed but not always paid out when they are due. Unpaid dividends are assigned the moniker “dividends in arrears” and must legally go to the current owner of the stock at the time of payment.

- An amount on a loan, cumulative preferred stock or any credit instrument that is overdue.

- It’s vital for investors to grasp what happens when corporations fall behind on their dividend obligations.

- The company pays dividends to common shareholders every other year, while preferred shareholders are guaranteed a $3 dividend per share.

- Dividends in arrears happen when a company can’t pay out its promised dividends on time.

- Preferred stock gives the investor a higher claim in liquidation, while preference shares provide the same claims as common stockholders.

New here? Not sure where your financial journey should be headed?

In any case, as with bonds, the investor expects to receive a monthly or quarterly payment of a certain amount. The shares can be sold on an exchange, like common stock, but the typical owner of preferred shares is in it for the income supplement. For example, assume a company has $1 million in retained earnings and issues a 50-cent dividend on all 500,000 outstanding shares.

Noncumulative Preferred Stock

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Bob Haegele is a personal finance writer who specializes in investing and planning for retirement. His hefty student loan burden inspired him to pay off his loans, and now he’s helping others get their finances in order. Understanding these numbers helps investors make smart choices about where to put their money and assess any risks with certain stocks. For example, if your $500 loan payment is due on Jan. 15 and you miss the payment, you are in arrears for $500 as of the next business day.

Great! Thank You for Voting.

No payments are made to the person or entity that held the stock at the time when the dividends were in arrears. This priority claim means a company must clear the backlog of unpaid dividends before giving money to common shareholders. Preferred stockholders watch their potential returns grow each time a payment is missed.

How is preferred stock different from preference shares?

This arrangement increases the possibility of a higher payoff and generally allows the stated preferred dividend rate to be set lower than otherwise. These unpaid dividends start piling up year after year, creating a backlog that the company must eventually address. Investors might start thinking the business isn’t doing the only personal finance tool that integrates with xero well financially. But there’s a catch – these dividends are often set up as cumulative, meaning if a company can’t pay one year, they must make it up later. This means that the interest is due to be paid on the maturity date of the loan, instead of in bits and pieces during the life of the loan like an annuity payment.

What happens if you own preference shares in a company that goes bankrupt?

Consider a company is issuing a 7% preferred stock at a $1,000 par value. In turn, the investor would receive a $70 annual dividend, or $17.50 quarterly. Typically, this preferred stock will trade around its par value, behaving more similarly to a bond. Investors who are looking to generate income may choose to invest in this security. The most common sector that issues preferred stock is the financial sector, where preferred stock may be issued as a means to raise capital. Cumulative preferred stock have the condition that any previously awarded dividends that have not yet been paid must be distributed before any common shareholder receives any dividend distribution.

Due to this lower cost of capital, most companies’ preferred stock offerings are issued with the cumulative feature. Generally, only blue-chip companies with strong dividend histories can issue non-cumulative preferred stock without increasing the cost of capital. Cumulative preferred stock is one type of preferred stock; a preferred stock typically has a fixed dividend yield based on the par value of the stock. This dividend is paid out at set intervals, usually quarterly, to preferred holders.

It is also important to note that preferred stock takes precedence over common stock for receiving dividend payments. This means that a share of cumulative preferred stock must have all accumulated dividends from all prior years paid before any other lower-tier share can receive dividend payments. The schedule of payments lists the dates your cumulative preferred stockholders will receive their dividends. These scheduled dividends are an obligation your company must honor sometime in the future. Under GAAP, an undeclared stock dividend is not a recognized liability.